Probability Pricing,

Not Prediction

BoxAI is an AI-driven research lab focused on how markets price uncertainty and where probabilistic assets deviate from no-arbitrage structures.

Why Prediction Markets

≠ Gambling

Prediction markets are not about guessing outcomes. They are mechanisms that transform uncertainty into tradeable prices.

Not Betting on Outcomes

The market does not reward who is “right” about the future. It prices uncertainty under strict settlement rules.

Deterministic Settlement

Outcomes are discrete, mutually exclusive, and settle into fixed cash flows — not subjective opinions.

Financial Engineering Structure

Prediction contracts are fully collateralized, cash-settled financial instruments, not entertainment wagers.

Industry News & Trends

Latest updates in the prediction market space

AI Probability Pricing Simulator

Real-time visualization of how probabilistic prices evolve, converge, and generate arbitrage returns.

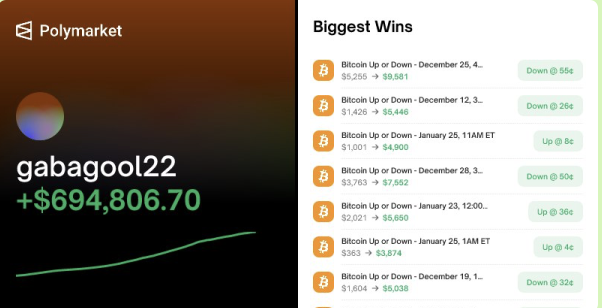

Multi-Strategy Market Domination

polymarket.com/@gabagool22

① Ultra-low probability lottery trades (<1%, ≤1¢)

② BTC / SOL 15-minute volatility capture

③ Passive liquidity provision in thin markets

Designed to profit across all market regimes.

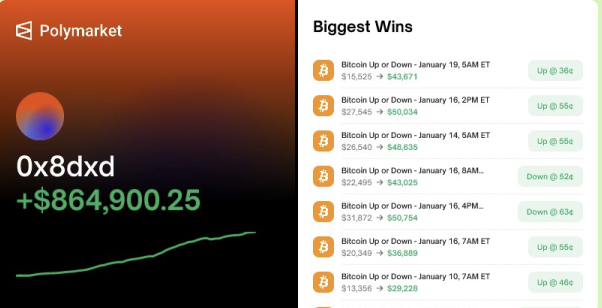

Crypto Repricing Sniper

polymarket.com/@0x8dxd

Waits for BTC / ETH / XRP to fully move first,

then exploits Polymarket pricing lag

with millisecond-level automated execution.

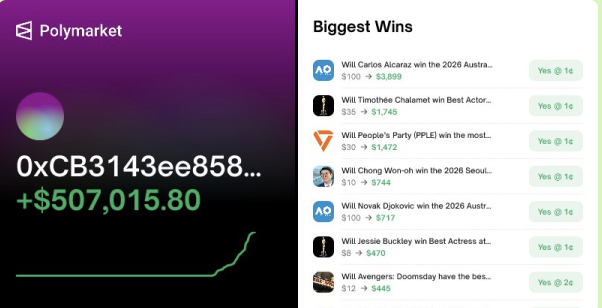

Political Market Hedge Engine

polymarket.com/@0xCB3143ee

Avoids hype-driven candidates,

accumulates undervalued outcomes only,

strict limit-order execution with no slippage.

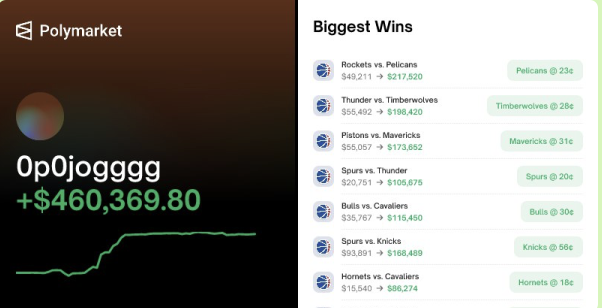

Ultra-Short Crypto Scalping

polymarket.com/@0p0jogggg

No directional bias whatsoever,

pure micro-volatility edge extraction,

consistent base income generation.

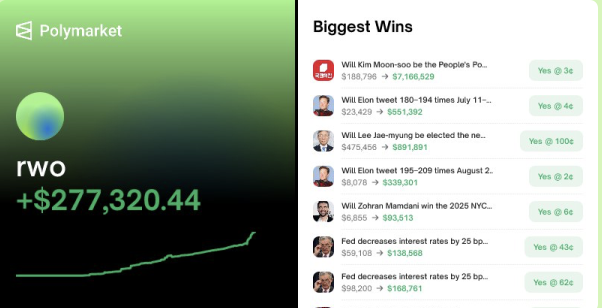

Late-Stage Price Convergence

polymarket.com/@rwo

Exploits near-settlement mispricing,

as outcomes converge toward 0 or 1,

profiting from delayed market adjustment.

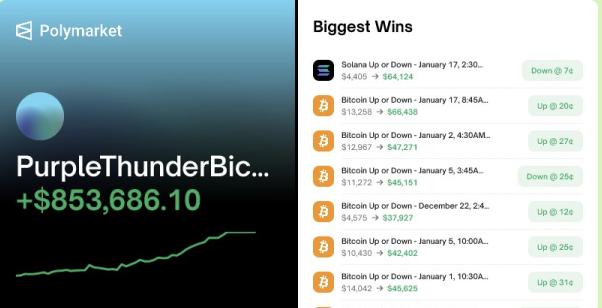

Hybrid Arbitrage Stack

polymarket.com/@PurpleThunderBicycleMountain

Wick Fishing on 15-minute markets,

Synthetic arbitrage when total < $1,

Hybrid stacking to smooth drawdowns and variance.

Pricing Uncertainty,

Not Predicting Outcomes

Prediction markets are evolving into a new financial layer.

BoxAI exists to identify where probability prices break,

and to systematically correct them.

We do not trade direction.

We trade probability mispricing.

We operate under strict no-arbitrage constraints.